Top 10 Sweepstakes Fraud Prevention Strategies for Secure iGaming Operations

Table of Contents

The sweepstakes iGaming market is booming, but so is fraud on sweepstakes platforms. iGaming businesses, iGaming companies, and gambling operators are all facing increased risks and must prioritize fraud prevention. Industry reports show iGaming fraud is skyrocketing with deep fake ID scams, bonus abuse, chargeback scams, multi-accounting and bot farms, referral fraud, money-laundering schemes disguised as play, and insider abuse or data breaches.

If unchecked, these threats can drain revenue, harm legitimate players, and trigger regulatory penalties.

Understanding Sweepstakes Fraud: Types and Impacts

Fraud Type

How It Works

Impact on Operators

- Revenue loss

- Flawed analytics

- Marketing budget waste

- Reduced player lifetime value

- Financial losses

- Penalty fees

- Regulatory penalties

- Legal consequences

- Reputational harm

Top 10 Sweepstakes Fraud Prevention Strategies

By adopting these actionable insights and steps, you can significantly reduce fraud risks while creating a more secure user experience.

Identity Verification & KYC Checks

Fraudsters often use fake or stolen IDs to create multiple user accounts. By implementing strong Know Your Customer (KYC) processes, operators can confirm each player’s identity before play. This means verifying government-issued IDs and matching user selfies. These advanced security measures stop identity fraud.

Best Practices:

- Implement automated ID verification tools

- Age verification and age restriction features to deter minors

- Cross-checking address-proof

These checks ensure only legitimate players gain access.

Multi-Factor Authentication

Enabling multi-factor authentication (MFA) blocks automated account attacks. Google’s research shows that adding a phone-based second factor blocks 100% of bot attacks. MFA greatly reduces the chance that a stolen password leads to account takeover.

Best Practices:

With GammaSweep, you can integrate Two-factor Authentication (2FA) Security to offer extra protection for players’ accounts. Both players and admins use two-step verification to ensure complete security.

Multiple Account Detection

Many sweepstakes frauds involve multiple accounts. Fraudsters create several accounts, often via VPN, to abuse the bonus system and exploit loopholes. This practice can give fraudsters unfair advantages over legitimate players. To combat this:

- Track device IDs and IP addresses. If one IP or device is tied to multiple accounts, flag those accounts as suspicious.

- Add CAPTCHA challenges on registration or login to block automated bots from mass-account creation.

- Enforce one account per user or device. Require unique contact info, such as phone number and email ID, for each account.

Best Practices:

A robust anti-fraud system detects duplicates by comparing user data. GammaSweep offers these capabilities out of the box, so you can start spotting risk quickly. If ten accounts all share the same payment info, they will be flagged by GammaSweep’s fraud detection features.

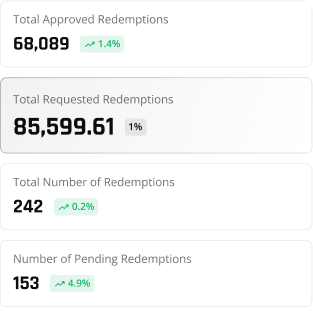

Transaction Monitoring

Continuous transaction monitoring watches financial flows. Operators set alerts for suspicious activity, such as many rapid small in-app purchases or huge withdrawals.

Best Practices:

- Setting anomaly alerts for unusual cash flows.

- Flagging accounts with repeated bonus redemptions or identical game-play sequences.

Real-time monitoring of purchases and redemption creates an audit trail that flags illegal activity and surfaces fraud risks before losses accumulate.

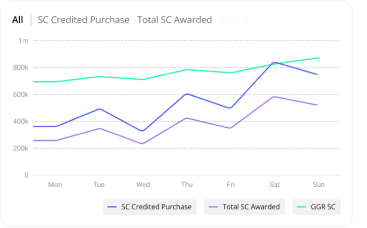

AI & ML for Behavioral Analytics

Artificial intelligence (AI) and Machine Learning (ML) have revolutionized iGaming fraud detection by enabling platforms to identify subtle fraud patterns indicative of deceitful activity. These systems analyze thousands of data points in real-time to flag suspicious behavior that would escape traditional systems.

Best Practices:

Partner with leading sweepstakes software providers and integrate AI-driven fraud detection and ML models that will continuously improve the fraud detection accuracy of your sweepstakes casino platform by learning from confirmed cases of fraud.

Secure Payment Infrastructure

The payment ecosystem represents a critical vulnerability point for sweepstakes platforms. Securing this infrastructure requires both technical measures and strategic partnerships with reputable payment processors who maintain their own advanced security measures. By offering multiple payment systems, including e-wallets, bank transfers, debit/credit cards, and crypto payments, operators can distribute risk while providing convenience for users.

Best Practices:

- Diversifying payment options also contributes to security by reducing dependence on any single method.

- Maintain full compliance with Payment Card Industry Data Security Standards (PCI DSS).

- Hire reputable sweepstakes software providers like GammaSweep, which integrate multiple secure payment gateways into your system seamlessly.

Cybersecurity Measures & Employee Training

Technical security measures alone cannot prevent all fraud risks. A comprehensive approach must include robust cybersecurity protocols and ongoing employee education. Human error remains a significant factor in security breaches.

Best Practices:

- Identifying and addressing vulnerabilities before exploitation.

- Proper handling of sensitive customer data.

- Limiting system access based on role-based permissions.

- Ongoing updates on evolving threats and enforcing prevention techniques.

Geolocation & VPN Restrictions

Geolocation and VPN restrictions stop fraudsters from masking their true location. They can fake their true location to bypass local rules like state or country bans, age restrictions, tax rules, or mandatory KYC checks tied to a jurisdiction. This lets them create accounts, claim region-restricted promotions, or launder money in places where enforcement is lenient.

Best Practices:

- Enforce geofencing or location restrictions per law. If certain USA states or countries have banned sweepstakes casinos, block those IPs.

- Block access from prohibited states or countries at the network edge and pair it with VPN detection and device checks to maintain compliance.

GammaSweep assures your business is safe and compliant with all these advanced features. Ensure 100% compliance with regulated sweepstakes markets with us.

AML Compliance

Anti-Money Laundering (AML) protocols form the regulatory foundation of fraud prevention in sweepstakes gaming. AML systems detect and stop criminals using your platform to hide or move illicit funds through deposits, play, and withdrawals.

Best Practices:

- Encrypt personal data both at rest and in transit.

- Monitor deposit/withdrawal cycles for money laundering.

- Flag large or rapid fund movements for review.

These compliance measures help igaming operators meet regulatory requirements.

Regulatory Compliance & Audits

In many regions, sweepstakes casinos follow rules similar to other online gambling operations. Staying compliant with iGaming business laws and financial regulations, operators must implement KYC and AML controls and keep all the records clear to maintain transparency.

Best Practices:

- Keep logs and reports of transaction reports for large payouts and other reports required by regulators.

- Undergo 3rd-party security audits and certifications to verify your platform is secure.

- Consult legal experts to ensure compliance with sweepstakes laws, anti-money laundering, and consumer protection rules.

If authorities see that you enforce KYC, AML checks, and record suspicious transactions, they’re confident you are mitigating fraud. Moreover, following industry best practices for compliance means fraudsters will avoid targeting you.

Stay Ahead in the Sweepstakes Industry

Key Takeaways

- Sweepstakes casinos face rapidly rising fraud. Preventing it is vital to protect revenue, player trust, sweepstakes site security, and compliance.

- Effective strategies combine strong identity verification and geofencing, as many leading online casinos do.

- Advanced tools such as AI and ML analytics, ID checks, and unified fraud detection dashboards help uncover evolving threats.

- By adopting these multi-layered defenses, operators can mitigate iGaming fraud and ensure a secure, compliant platform for genuine players.

- Inform users about security measures, privacy policies, and data usage through clear communication and consent flows to build trust and ensure compliance.

How GammaSweep Builds Comprehensive Sweepstakes Security Strategies?

We design fraud prevention in sweepstakes gaming around layered defenses for risk mitigation and genuine users’ protection. With our advanced online gaming fraud protection features, you can detect threats early and secure sweepstakes operations. Our platform combines:

- Automated controls

- Identity & KYC verification

- Behavioral analytics & machine learning models

- IP analysis & geofencing models

- Strong authentication & access control

- Real-time alerts

- Operational support

READY TO START A CONVERSATION?

Frequently Asked Questions about Secure Sweepstakes Operations

What is the most common type of fraud in sweepstakes casinos?

What are the regulatory requirements for fraud prevention in sweepstakes platforms?

Are CAPTCHA effective for fraud prevention in sweepstakes?

What are the top indicators of suspicious player activity?

What onboarding steps reduce fraud during the sign-up process?

Which sweepstakes platform has the fastest launch?

Who offers the best sweepstakes fraud prevention?

How do VPN detection and geoblocking work together?

How does transaction monitoring detect money laundering?

When should I consult legal experts about sweepstakes compliance?

Consult legal professionals before you launch your sweepstakes gaming software. If you already have a sweepstakes platform but want to expand into new states or countries, then you must seek expert help to take care of all regulations. GammaSweep offers legal consultation services to guide pre-launch checks, expansion reviews, and incident response, all under one roof to ensure your sweepstakes business journey is smooth and compliant.